Digital Transformation = Economic Transformation

“A double-sided Equation”

By TTIFC, Staff Writer, January 2022

” Universal access to financial services is within reach—thanks to new technologies, transformative business models and ambitious reforms… As early as 2020, such instruments as e-money accounts, along with debit cards and low-cost regular bank accounts, can significantly increase financial access for those who are now excluded. “

Jim Yong Kim

President, World Bank Group

The global economy is undergoing a digital transformation within the financial services sector. The digitalization of payment spaces will result in fundamental changes to how both the private and public sectors operate, and how they deliver value to customers. As such, there should be a focus on how the shift to digital financial services within society through digital transformation, translates to the economic transformation of economies around the world, specifically Trinidad and Tobago.

The Benefits Of Digital Financial Services

Digital financial services are financial services (for example payments, remittances, and credit facilities) accessed and delivered through digital channels where both parties, the payer, and the payee, use electronic mediums to exchange money. This exchange can occur using:

- Credit/Debit Cards

- Net Banking

- UPI -A Unified Payment Interface is a smartphone application that allows users to transfer money between bank accounts. It is a convenient, safe, and secure mode of initiating digital payments.

- E-Wallets

- Payment via email and SMS

Digital Financial Services (DFS) enabled by FinTech offers several advantages to businesses, governments and consumers. They have the potential to lower operational and transactional costs, increase the speed of conducting business, and facilitate greater security and transparency. It also allows for the creation of customized financial services which can increase company market share while simultaneously increasing the access to and variety of services available to a wider segment of society, particularly the vulnerable. The use of DFS allow for a rapid and secure way for governments to conduct social transfers and other forms of financial assistance. It has the potential to strengthen accountability, reduce leakage due to corruption and theft, improve the ability to track government payments and evaluate the impact of interventions. Through electronic payments and transactions, consumers can transfer funds, pay bills, and purchase goods and services remotely, which allows for greater convenience and adherence to Covid-19 safety protocols. Additionally, financial services tailored to customers’ needs and financial circumstances are made possible by the payment, transfer, and value storage services embedded in the digital transaction platform itself, and the data generated within it. Moreover, lower costs of digital transactional platforms — both to the provider and the customer — allow customers to transact locally in irregular, smaller amounts, helping those who need to manage their characteristically uneven income and expenses. The increased availability and access offered by DFS can improve the economic participation of women and thus promote economic empowerment. The disparity in access to finance between genders are a real concern in many countries as statistics continue to show disproportionate economic and financial participation by women.

A study in Kenya shows that greater access to financial services reduced extreme poverty among women-headed households by 22 percent as it allowed 185,000 women to leave farming and develop business or retail activities (World Bank 2018).

The Relationship Between Digital Transformation Of Financial Services And Economic Transformation

Access to affordable financial services is critical for poverty reduction and economic growth (World Bank Group, 2020). At a microeconomic level, financial inclusion is a key contributor to economic development. Customers transact more online when they experience the ease, convenience, and security of online payments. This means that more and more people feel comfortable purchasing online, investing digitally, and transferring funds via electronic mediums. This strengthening of consumer confidence in the use of DFS increases the velocity of money or money movement in a country. This boosts the contributions of online businesses to the increased demand for goods and services, and the positive impact on economic growth for a country.

Furthermore, an efficient digital payment infrastructure facilitates trade, services, and transfers of funds, fostering economic interactions by eliminating or reducing market frictions and costs. Consumption and trade increase, in turn, support higher production and thereby overall economic development. (Zandi, 2013)

A Closer look at Trinidad and Tobago

As of January 2020, 77% of the population had access to internet connectivity whilst 136% of the population had access to mobile connectivity. This data implies that at least one person in every household in T&T has access to a digital platform.

————————————————————————————————

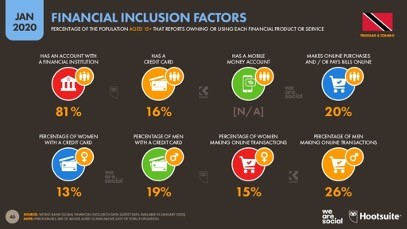

More than ¾ of the population has an account with a financial institution. Despite this, only 1/5 of the population utilizes digital financial services to conduct their economic activities.

Figures 1 and 2 give evidence that despite Trinidad and Tobago’s population having access to financial institutions and technological infrastructure, there is a low usage of DFS for conducting online financial transactions. Increased options of digital platforms, public education, and training for the usage of digital financial services all form part of the necessary ecosystem to create the roadmap to increase the adoption and usage of DFS. In addition to this, the proper implementation and execution of DFS within government agencies, businesses and organizations are extremely pertinent and can act as a catalyst to achieving the goal of increased adoption and usage within the population.

At the TTIFC, we continue to promote the adoption of digital financial services within the public and private sectors in Trinidad and Tobago. Two main elements of our action plan is working with key stakeholders to accelerate the digitalisation payments across all government agencies and creating a national strategy for increasing financial inclusion.

As ‘Your Resourceful Ally’ the TTIFC continues to collaborate and advise on the development of the required enabling ecosystem to foster FinTech integration, cashless transformation, and future-ready digital financial services. We understand that the adoption, implementation, and successful execution of digital financial services across all sectors will assist in the growth, expansion, and diversification of the local economy and promote a better life for our citizens.

References

Agur, Itai, Soledad Martinez Peria, and Celine Rochon. Digital Financial Services and the Pandemic: Opportunities and Risks for Emerging and Developing Economies. Pdf. International Monetary Fund Research, July 1, 2020.

“All ‘Bout Digital Money and Its Journey Ahead!” Lyra India. September 29, 2020. Accessed December 08, 2021. https://www.lyra.com/in/all-bout-digital-money-and-its-journey-ahead/.

Author Shubhangi Bhatia Shubhangi Is a Content Marketer at Razorpay. A Marketing Enthusiast, Author Shubhangi Bhatia, and Shubhangi Is a Content Marketer at Razorpay. A Marketing Enthusiast. “Digital Payments: Definition and Methods – Razorpay Payment Gateway.” Razorpay Learn. September 24, 2021. Accessed December 08, 2021. https://razorpay.com/learn/digital-payments-india-definition-methods-importance/#:~:text=Digital payments are transactions that take place via,promote and encourage digital payments in the country.

Digital Financial Services. Pdf. World Bank Group, April 2020.

Kemp, Simon. “Digital 2020: Trinidad and Tobago – DataReportal – Global Digital Insights.” DataReportal. February 18, 2020. Accessed December 08, 2021. https://datareportal.com/reports/digital-2020-trinidad-and-tobago.

“The Trinidad and Tobago Financial Centre (TTIFC).” Accessed December 8, 2021. https://www.ttifc.co.tt/?catid=0&id=103.

World Bank Group. “Digital Financial Inclusion.” World Bank. February 19, 2016. Accessed December 08, 2021. https://www.worldbank.org/en/topic/financialinclusion/publication/digital-financial-inclusion.