EFT 101: Understanding the basics of Electronic Funds Transfer

by TTIFC Staff Writer

Electronic Payments

Electronic payments refer to any non-cash and non-paper-based means of making a payment. The ability to complete financial transactions via electronic means has existed since the development of automated teller machines (ATMs), LINX systems (to facilitate debit cards) and credit cards in the 1990s (CBTT, 2009). Today, individuals and businesses can move funds from one account to another and between Financial Institutions with the use of a computer network which is commonly known as Electronic Funds Transfer (EFT). EFTs move money across an online network either between banks or directly from person to person, and frequently replace paper-based methods for making payments like cheques and cash (Bank Rate, 2022).

Understanding the back-end process

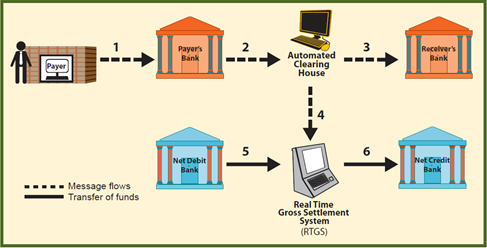

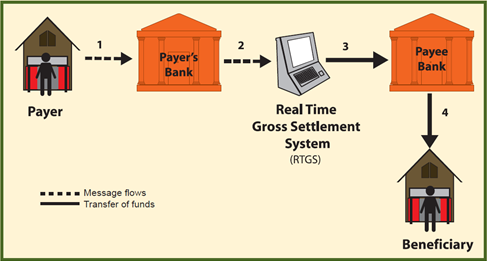

To successfully transfer funds from one party to another in a secure, timely and accurate manner, a robust computer system or network is required. These are known as clearance and settlement systems which form the ‘backbone of a payment system’ (CBTT, 2009). Clearance in a payment system refers to the process of verification to ensure that the payer has the money to make the payment and that the means by which the payment is being made is valid. Settlement refers to the actual exchange of value from the payer to the beneficiary or the person in receipt of the funds. Essentially, clearance must be completed ahead of settlement (CBTT, 2009).

In Trinidad and Tobago, there are two major electronic payment transfer mechanisms which accept instructions to complete the processes previously discussed. These are: Automated Clearing House (ACH); and the Real Time Gross Settlement (RTGS) system. ACH allows for large volume, low value (under $500,000) payments while RTGS is used for high value ($500,000 and over) time critical payments (CBTT, 2009). The distinct difference between both systems is how they are processed.

This is illustrated by figures 1 and 2.

Types of EFTs

The following are 4 types of EFTs which are commonly used by individuals and businesses:

Direct Debit Transaction: this is an ACH transaction which involves the electronic transfer of a pre-authorised payment from a customer’s account to the account of a beneficiary on the instruction of the beneficiary. For example, your monthly Netflix subscription payment is automatically deducted from your bank account on the date of renewal.

Direct Credit Transaction: this is another ACH transaction which transfers a payment from a customer (an individual or company) into the account of the beneficiary on the instruction of the customer. In Trinidad and Tobago, the Integrated Global Payment (IGP) system which has been used in the public sector is an example of this type of EFT. This system facilities the payment of salaries, wages and pensions, from the public sector, directly into the bank accounts of citizens.

ATM Transactions: are categorised as EFTs, as paying bills, making deposits or withdrawals all involve moving money from accounts electronically

Online banking: using your bank’s online banking system to conduct business allows you to make instant electronic transactions from one account to another and manage one’s personal accounts.

The Benefits of EFT in the Public Sector

The introduction of EFT systems to facilitate payments to and by the Government is essential to the adoption and integration of FinTech technology in Trinidad and Tobago. There are several benefits associated with embedding electronic payments into the payments processes at Ministries, Departments and Agencies (MDAs).

Firstly, more digital payments can be facilitated throughout the public sector when EFT systems are implemented. This can lead to a reduction in cashiering and other transaction costs. For example, currently, an individual can experience less wait times and hassle associated with in-person transactions, by paying their fixed fee penalty to the Ministry of Works and Transport online via the ministry’s portal using a credit card.

EFT systems also provide an efficient, convenient and safe option for citizens to make payments to the Government. Moreover, EFT systems also ensure certainty of payments in the collection of fees and taxes, as these can be tracked and observed via a digital trail. This is opposed to solely relying on physical receipts and other paperwork.

EFT adoption is a key part of accelerating the digitalisation of payments across the public sector in Trinidad and Tobago, which the TTIFC is actively committed to achieving. To ensure that these benefits become a reality in Trinidad and Tobago, the TTIFC has begun developing an Electronic Funds Transfer Framework and Policy to streamline the enablement of EFT payment methods for use by MDAs. This practical set of actions would be underpinned by international best practice, to set the stage for the digitalisation of payments and ensure standardisation across MDAs.

References

Bank Rate (2022) What is electronic funds transfer?. Available at: https://www.bankrate.com/glossary/e/electronic-funds-transfer/#:~:text=An%20electronic%20funds%20transfer%20(EFT,different%20types%20of%20payment%20systems

CBTT (2009) The Payment Systems in Trinidad and Tobago. [pdf]. Available at: https://www.central-bank.org.tt/sites/default/files/page-file-uploads/The%20Payments%20System%20In%20Trinidad%20%26%20Tobago.pdf