FinTech and the Evolution of Financial Services

Submitted by Michelle Salandy, Ph.D., Research Officer, T&T IFC

There are many definitions of the term FinTech, which is classified as a portmanteau or a blending of the parts of the words ‘financial’ and ‘technology’.

The Financial Stability Board (FSB) defines it as “technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions, and the provision of financial services.” [1]

Despite the variations in the definition of FinTech used by international bodies and national authorities, one clear view is that FinTech is more than payment innovation. FinTech represents a revolution of all financial services that employ artificial intelligence (AI), application programming interfaces (APIs), cloud computing and distributed ledger technologies (DLTs) such as blockchain, to drive financial service innovation. This evolution is occurring in many different areas of financial services.

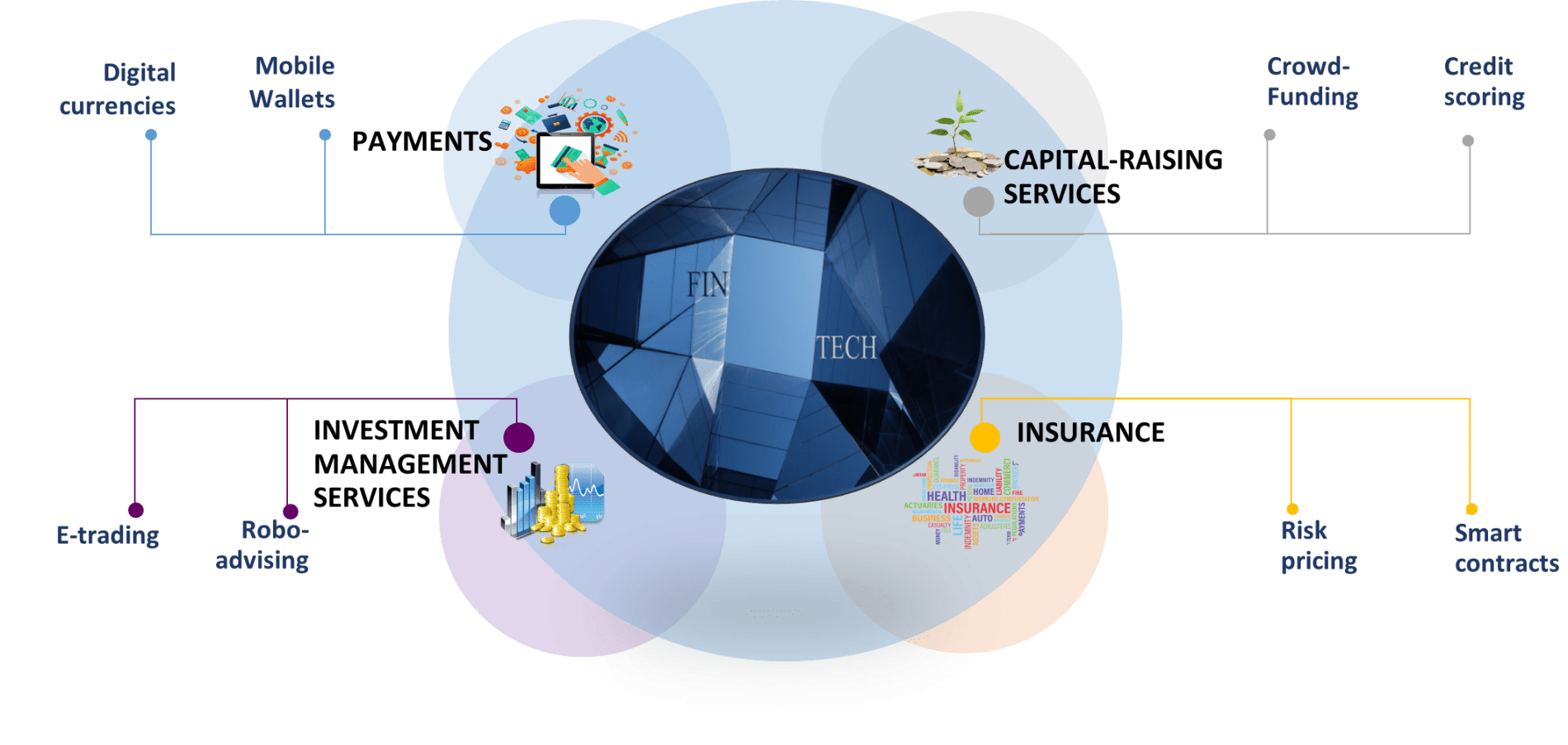

As shown below these ground-breaking technology solutions have been leveraged in areas such as Payments, Capital-Raising Services, Insurance, and Investment Management Services. They have also been leveraged in the ancillary service sectors inclusive of the provision of mobile wallets, crowdfunding, robo-advising, and risk pricing.

APPLICATIONS OF FINTECH

The developments in each of the four segments identified show just how much FinTech is changing the world of finance at a rapid scale.

The developments in each of the four segments identified show just how much FinTech is changing the world of finance at a rapid scale.

Payments

FinTech has advanced the payment space from the limit of debit cards and credit cards and has changed the way we manage our finances. Today we are familiar with hearing and seeing the terms mobile wallet such as Endcash and cryptocurrency such as Bitcoin in today’s media. We are also hearing about the new innovative Central Bank Digital Currencies that are being used in the Caribbean by the Bahamas (Sand Dollar) and the Eastern Caribbean (DCash). These advances increase the ease and speed of doing business by making money transfers, lending, and investing effortless and secure without the need to visit the bank or have in-person transactions.

Capital Raising Services

At the core of FinTech and the evolution of financial services, is the use of technology to increase access to capital outside of conventional investors such as banks. Crowdfunding platforms like FundMeTnT have lowered the cost of intermediation. It has also transformed the traditional fundraising landscape to finance the activities of several individuals, charities, start-ups, and non-profit organisations.

Recent research by the staff at the World Bank Group, IMF and ECB also recognise the use of FinTech for determining creditworthiness. FinTech has permitted the use of advanced credit scoring methods, by expanding on conventional bank loan screenings with the use of new tools to collect and analyse data on customers[2]. For example, credit rating FinTech companies can now utilise alternative data like social signals, psychometrics, biometrics, web browsing, news feeds, online ratings, images, and percentile scoring amongst similar borrower groups. All these combined with intelligent and self-learning algorithms expand credit access to individuals and micro, small, and medium enterprises, and improve efficiency and customer experience.

Insurance

FinTech companies are also building variable premium computing mechanisms with alternative data to reduce information asymmetries and advance the insurance sector. Predictive behavioural analytics combined with intelligent and self-learning algorithms now allow companies to determine whether to give insurance, provide different terms and conditions, or offer alternative payment options. For instance, the provision of tailored insurance by Maritime’s CoPiloTT app is one such example. The customer’s risk and insurance rate are based on habits such as how the customer drives, average distance driven, and speed, instead of only the traditional factors such as sex, age, and the date of driver’s licence issuance.

Investment Management Services

FinTech companies are not only integrating conversational artificial intelligence platforms to provide chat-style customer support via a virtual banking assistant but have taken that virtual assistant beyond the ‘simple’ automation of client interaction. Robo-advising has broadened access to finance and wealth management services by disrupting the asset management sector. The addition of robo-advisory services provides algorithm-driven recommendations and customised low-cost automated portfolio management to a largely underserved population who were not able to afford such services. FinTech companies like Robinhood are also enabling investors to trade for ‘free’, whilst GSec helps governments sell and trade their digital securities to retail and institutional investors.

This evolution of new financial services is sure to continue to advance as FinTech continues to improve non-cash payment options and automate the delivery and use of financial services in a virtual world. One can expect the Trinidad and Tobago International Financial Centre to continue to support the use of emerging technology and the growth of the local FinTech ecosystem as a range of benefits can be obtained from the use of artificial intelligence, robotics, and blockchain technology in the financial services sector. At its core, FinTech is utilised to help companies, business owners and consumers better manage their financial operations, cost, and risk. It can also lead to overall increases in financial inclusion and economic growth.