CASHLESS SOCIETIES AND THE BENEFITS

The use of the term cashless and the increased possibility for a cashless society are mentioned in the media, but what does the term cashless really mean? A cash transaction occurs when one uses cash as a form of payment to settle a debt when a good or service is acquired. Thus, cash is readily accepted as the form of payment. Cashless therefore means being able to purchase goods or serviceswithout using cash as a form of payment.

A cheque is one of the original cashless payment options. Debit and credit cards can also be used to facilitate cashless payments via Point of Sale (POS) terminals or online via payment gateways. Merchants also sell preloaded gift cards which can be used at any point in time as a means of payment. The increased development for cashless payments options for public transport has further reduced the need to carry cash for low-value high-frequency purchases. For example, in South Africa, the Zapper app lets customers pay for taxi rides by scanning a QR code and in Trinidad and Tobago commuters can use the TT RideShare app on their mobile phones to book and pay for taxi services with their credit cards.

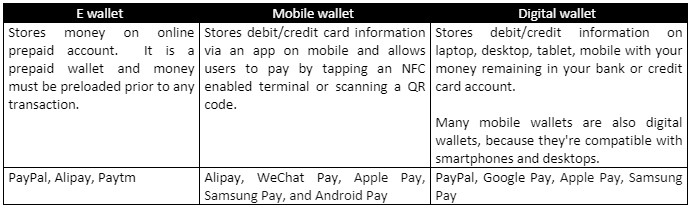

Online banking platforms are being increasingly utilised to facilitate Peer to Peer (P2P) or Peer to Business (P2B) transfers. Electronic, Mobile orDigital wallets enable users to electronically store cash and their bank account or debit or credit card information to facilitate digital payments with their mobile, desktop, tablet, laptop or smartwatch.

The Capgemini 2019 World Payments Report indicates an annual growth rate of 12 percent in the volume of global cashless transactions during 2016-2017. This increase from the 10.4 percent recorded in 2015-2016 is an indication of the continued growth in cashless payments. This growth can be attributed to changes from the traditional dependence on cash as the preferred method for payment. A recent study by PwC identified that approximately 50% of millennials would prefer to pay for small items and split bills with their peers using their mobile phone rather than cash.

Many countries are aiming to go cashless and are increasing the use of cashless payment options to reap several benefits which include but are not limited to:

- Increase access to financial services at a lower cost which increases financial inclusion and reduces the underbanked and unbanked population.

- Reduce the informal economy. For instance, a 5 percent increase in digital payments per year for five consecutive years can reduce the informal economy by 10.8 to 12.9 percent (Digital Payments and the Global Informal Economyby A.T. Kearney and VISA). Employees in formal economies also benefit from better salaries, health insurance benefits, vacation, sick leave and other social benefits.

- Improve transparency and due diligence which reduces tax evasion and increases tax collection, Government revenue and GDP. For example, the A.T. Kearney and VISA study found that increasing digital payments by 10 percent per year for five consecutive years could lift global GDP by approximately US$1.5 trillion by 2021.

- Increase accountability and reduceincidence of counterfeit currency, money laundering, human trafficking, and drug trafficking which in turn reduce the need for legal services.

- Reduce risk of crimes such as fraud and robberies.

- Reduce the cost of minting currency.

Locally, efforts are being made to increase the cashless payment options available so that Trinidad and Tobago can join the movement towards a cashless society and reap the associated benefits. The Trinidad and Tobago IFC is working with local stakeholders to develop a local FinTech ecosystem which should result in the launching of new cashless payment options that will increase the ease of doing business in Trinidad and Tobago.