The FinTech Revolution and the Role of Regulators in Financial Sector Development

Submitted by Michelle Salandy, PhD.

A well-developed well-driven FinTech or financial technology ecosystem has the potential to bring increased diversity and advances to the financial sector of Trinidad and Tobago. The financial sector has consistently been one of the five highest contributors to the country’s GDP, adding US$1.8 billion to earnings in 2018 (Ministry of Finance Review of the Economy 2019). This sector is characterised by a solid banking faction, excess liquidity, low levels of systemic risk build-up and a large capital base with Stock Exchange Market Capitalisation of over US$20 billion and Commercial Bank assets of over US$21 billion (Central Bank of Trinidad and Tobago Financial Stability Report 2018; Ministry of Finance Review of the Economy 2019).

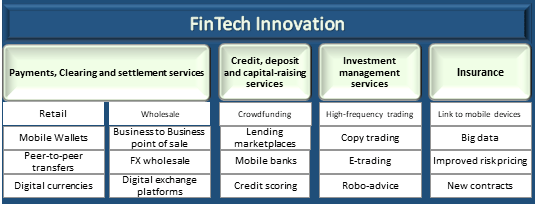

The Financial Stability Board (FSB) defines FinTech as “technologically enabled financial innovation that could result in new business models, applications, processes, or products with an associated material effect on financial markets and institutions, and the provision of financial services.” The term FinTech is generally associated with digital banking and payment systems, but covers many other broad areas including credit, deposit and capital-raising services, investment management services and insurance (Thakor 2019). FinTech is revolutionising the financial sector and leveraging innovations like artificial intelligence, robotics and blockchain, to drive financial service innovation with ground-breaking technology solutions such as crowd funding, peer-to-peer transfers and robo-advisory services (refer to Figure 1).

Figure 1 Technology enabled innovation within the financial service sectors

Source: Adapted from Thakor 2019

The FinTech industry has been gaining strength throughout the Latin America and the Caribbean (LAC) region with more than 700 platforms that currently offer financial solutions based on new technologies. Of these, 32.7 percent are in Brazil, 25.6 percent in Mexico, 11.9 percent in Colombia, 10.2 percent in Argentina, and 9.2 percent in Chile (IDB and Finnovista 2017). Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department of the IMF has stated that every country, including the countries of the Caribbean would be wise to prepare and embrace the FinTech revolution, in the hope of realising its far-reaching social and economic benefits despite the challenge of balancing between enabling financial innovation and addressing financial integrity, consumer protection, and financial stability. A thriving FinTech ecosystem has been commended for improving tax collection, promoting financial inclusion, increasing accountability, increasing transparency and security and improving efficiency, employment, foreign direct investment, foreign exchange earning potential and economic growth (OECD 2019; Lund, White, and Lamb 2017; Manyika, Lund, Singer, White, and Berry 2016; Manzali de Sá-Kaye 2020).

The legal and regulatory frameworks must not only be addressed swiftly to reduce the current barriers of entry into the financial sector but to provide regulatory oversight of the industry. Country-specific regulation must now be tailored to the new business models as their risks are different from those of traditional financial institutions (Canuto 2020, Berkmen et al. 2019; International Monetary Fund and World Bank 2019).

Regulators in many countries have accepted the fact that regulation is crucial for development of their FinTech ecosystem[1]. Vives (2017) proposed that regulation needs to be adapted so that FinTech delivers the promised benefits without endangering financial stability. The 2019 IMF-World Bank Global FinTech Survey shows that 76 percent of respondents indicate some level of modifications to their regulatory approach to facilitate the development of FinTech and supervisory capacity, while 87 percent indicated that they have undertaken measures to increase their capacity to keep up with FinTech developments (International Monetary Fund and World Bank 2019).

FinTech is also on the agenda in Trinidad and Tobago but more needs to be done by regulators as the FinTech ecosystem is continuous, progressive, and widespread. Changing fiscal policy directives and an expansion of the regulatory legislature are essential to drive the FinTech landscape. Advances in the industry can only occur if the regulation of the Financial Institution Act, 2008 (FIA) is modified. For example, before the adoption of the E-Money Issuer Order 2020, only financial institutions licensed to conduct the ‘business of banking’ or ‘business of a financial nature’ as defined in the FIA were allowed to issue e-money. The adoption of this order, however, allows new entrants to apply to the Central Bank to issue e-money.

A study by the IDB and Finnovista (2017) suggests the creation of regulatory sandboxes to (i) establish a more direct dialogue between the FinTech industry as a whole and supervisors and regulators in particular, to understand the nature of the businesses; and (ii) allow for a smoother transition for FinTech platforms and ventures and their controlling entities, toward oversight based on actual industry activities. Herrera and Vadillo (2018) have also proposed the use of regulatory sandboxes to create a controlled environment in which companies can test their services under the financial regulator’s oversight.[2] A regulatory sandbox in Trinidad and Tobago will not only allow regulators to understand the structure of new start-ups and the adequacy of the regulatory framework but allow innovative companies to test the feasibility of their innovations in a controlled real-world environment.

Other measures such as creating spaces for public policy-promoting dialogue can be supported. For example, Mexico, Colombia, Brazil, and Chile have already begun to successfully explore changes in the regulation of FinTech platforms by directly consulting the FinTech entrepreneurs on their requirements and needs (IDB and Finnovista, 2017). Thus, collaborative ventures such as the FinTech Stakeholder Engagement Session hosted by the Trinidad and Tobago International Financial Centre (T&T IFC) and the launch of the FinTech Association of Trinidad and Tobago (FinTech TT) should be supported as they provide a space for dialogue among the representatives from financial services, technology, and related sectors. A core FinTech group can establish a point of contact for firms, coordinate with domestic regulators, monitor developments and assess and guide FinTech applications. Initiatives such as this, allow for discourse with the Government and regulators to identify niche spheres, bolster better practices and foster the development of a FinTech-enabled financial services industry.

Innovation hubs can also be established to complement other initiatives. Herrera and Vadillo (2018) recommends that countries in LAC set up specialised FinTech offices or departments within their supervisory authorities similarly to countries such as France, the Netherlands, Singapore, Spain, and the United Kingdom. It is also suggested that a clear policy directive on FinTech establishments would encourage FinTech start-ups, enhance the current digital payment landscape and pave the way for new products or processes.

The full embrace of FinTech innovations by public institutions and a confirmation of support by the government can also aid consumer adoption of new products and technology platforms. Herrera and Vadillo (2018) also recommend governments to promote their FinTech sector as part of its innovation policies making adequate resources available for its implementation through measures such as:

- Granting tax incentives to companies and investors.

- Assistance for financing and investment in entrepreneurs’ capital.

- Technical and legal advice.

- Creation of innovation spaces or laboratories.

- Entrepreneurship competitions.

- Business incubation and acceleration programs.

- Mentoring practices.

- Promotion of partnerships and strategic agreements with financial institutions.

- Creation of FinTech venture capital funds.

There are so many untapped benefits that can be derived from the development of the FinTech ecosystem, but many now echo the sentiment that regulation and regulators have a role to play. The prevalence of smart phone technology and high internet penetration levels allow for the ready adoption of e-money and the facilitation of a larger e-commerce segment within the business sector of Trinidad and Tobago. While the current banking and non-banking entities appear to be particularly well developed, there is a place for FinTech to make markets work better for average people. Expansion of the sector does not only make it easier for local customers to purchase goods, but also expands market reach, as it brings the Trinidad and Tobago market one step closer to foreign consumers outside our borders. An environment that balances both the fostering of financial innovation while upholding investor protection and financial stability can occur through legislative upgrades and open dialogue.

References

Adrian, T. (2019, May 9). Paving the Way for Fintech. Retrieved from https://www.imf.org/en/News/Articles/2019/05/09/sp050919-paving-the-way-for-fintech

Berkmen, P., Beaton, K., Gershenson, D., Granado, J. A. del, Ishi, K., Kim, M., Koop, K., and Rousset, M. (2019, March 26). Fintech in Latin America and the Caribbean: Stocktaking. Retrieved from https://www.imf.org/en/Publications/WP/Issues/2019/03/26/Fintech-in-Latin-America-and-the-Caribbean-Stocktaking-46677

Canuto, O. (2020, January 29). How Latin America Can Make Fintech a Priority. Retrieved from http://www.americasquarterly.org/content/how-latin-america-can-make-fintech-priority

Central Bank of Trinidad and Tobago (CBTT), Payments System Council. (2011, September). The Role of Banks Relative to Non-Banks in Electronic Money Operations. Retrieved from https://www.central-bank.org.tt/psc/Publications/The_Role_of_Banks_Relative_to_NonBanks_in_Electronic_Money_Operations.pdf

Central Bank of Trinidad and Tobago, CBTT. (2018, November). Draft E-Money Policy. Consultation Paper Retrieved from https://www.central-bank.org.tt/sites/default/files/page-file-uploads/E%20MONEY%20POLICY.pdf

Central Bank of Trinidad and Tobago, CBTT. (2019). Financial Stability Report 2018. Retrieved from https://www.central-bank.org.tt/sites/default/files/reports/financial-stability-report-2018_0.pdf

Dettoni, J. (2020, March 18). Which FDI sectors could benefit from the coronavirus crisis? Retrieved from https://www.fdiintelligence.com/article/77085?utm_campaign=April 1st newsletter&utm_source=emailCampaign&utm_medium=email&utm_content=

Financial Stability Board (FSB). (2017, May 12). Monitoring of FinTech. Retrieved from https://www.fsb.org/work-of-the-fsb/policy-development/additional-policy-areas/monitoring-of-fintech/

Herrera, D., & Vadillo, S. (2018, March 7). Regulatory Sandboxes in Latin America and the Caribbean for the FinTech Ecosystem and the Financial System. Retrieved from https://publications.iadb.org/en/regulatory-sandboxes-latin-america-and-caribbean-fintech-ecosystem-and-financial-system

IDB (Inter-American Development Bank) and Finnovista. 2017. FINTECH Innovations that you

may not know were from Latin America and the Caribbean. Retrieved from https://publications.iadb.org/handle/11319/8265.

International Monetary Fund, & World Bank. (2019, June 27). Fintech: The Experience So Far. Retrieved from https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/06/27/Fintech-The-Experience-So-Far-47056

Lund, S., White, O., & Lamb, J. (2017). Economics Chapter 13. The Value of Digitalizing Government Payments in Developing Economics”. Digital Revolutions in Public Finance. USA: International Monetary Fund. Retrieved from https://doi.org/10.5089/9781484315224.071

Madden, M. (2020, February 18). Regulators, fintech players examine growing industry. Retrieved from https://barbadostoday.bb/2020/02/17/regulators-fintech-players-examine-growing-industry/

Manyika J, Lund S, Singer M, White O, and Berry C. (2016, September). Digital Finance for All: Powering Inclusive Growth in Emerging Economies. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/Employment%20and%20Growth/How%20digital%20finance%20could%20boost%20growth%20in%20emerging%20economies/MG-Digital-Finance-For-All-Full-report-September-2016.ashx

Manzali de Sá-Kaye, T. (2020, January 21). How a Fintech App Is Helping Peruvian Entrepreneurs. Retrieved from https://www.americasquarterly.org/content/how-fintech-app-helping-peruvian-entrepreneurs

Ministry of Finance. (2019). Review of the economy 2019. Retrieved from https://www.finance.gov.tt/wp-content/uploads/2019/10/REVIEW-OF-THE-ECONOMY-2019.pdf

Organisation for Economic Co-operation and Development OECD. (2019, nd) Lessons from the EU-SPS programme: Implementing social protection strategies. Retrieved from

https://www.oecd.org/dev/inclusivesocietiesanddevelopment/Lessons_learned_Implementing_social_protection_strategies.pdf

Republic of Trinidad and Tobago. Legal Notice No. 284 E-Money Issuer Order, 2020.

Thakor, A. (2019, March 7). Fintech and Banking: What Do We Know? Journal of Financial Intermediation. Retrieved from https://doi.org/10.1016/j.jfi.2019.100833

Vives, X. (2018, January 8). The Impact of Fintech on Banking. Retrieved from https://european-economy.eu/2017-2/the-impact-of-fintech-on-banking/

Zhang, T., & Imf. (2019, June 10). Balancing Fintech Opportunities and Risks. Retrieved from https://www.imf.org/en/News/Articles/2019/06/10/sp061019-balancing-fintech-opportunities-and-risks

[1] For example: Brazil integrated FinTech issues into the existing regulatory and legal framework and passed a bill to regulate FinTech companies on March 2018 to provide legal frameworks for companies that offer alternative financing and electronic payment; Mexico introduced new and comprehensive FinTech-specific legislation; the Chamber of Deputies (Lower House of Congress) in Argentina approved the “Ley de Emprendedores” (“EntrepreneursLaw”) in November 2016 to regularise crowdfunding platforms by allowing the public placement of a fraction of these start-ups’ shares so that small investors can invest in them, even offering tax benefits; Uruguay also passed a regulation in 2018 which focussed on peer-to-peer lending; Peru passed an e-money law in 2013 and the Central Bank issued a circular to regulate electronic money payment in 2016; the government and Bank of Lithuania have also streamlined licensing procedures, offered regulatory sandboxes for testing financial innovation, accelerated the development of RegTech solutions, and built a platform for blockchain-based solutions (Berkmen et al. 2019; Herrera and Vadillo 2018; International Monetary Fund and World Bank 2019; Zhang and IMF 2019).

[2] The Central Bank of Barbados (CBB) and the Financial Services Commission (FSC) established a Regulatory Sandbox in 2018 where entities can do live testing of their products and services (Madden 2020).