Accelerating the Digitalisation of Payments Across the Government of Trinidad and Tobago

The digitalisation of government payments involves shifting from paper-based payments—that is, payrolls, benefits, pensions, social programs, fines, fees, taxes, and other payments —to some form of electronic or digital payment (World Bank 2020).

Accelerating the digitalisation of payments across all government agencies is one of the key mandate pillars of the Trinidad and Tobago International Financial Centre (TTIFC). Achieving this shift can improve the way government makes and receives payments, contribute to better government efficiency, support economic activity, and enhance public welfare by promoting greater financial inclusion for unbanked and underbanked citizens.

However, transitioning from cash to digital payments is a shift that requires a methodical approach and thoughtful collaboration across key stakeholders, including Ministries and Government Agencies (MDAs), Payment Service Providers (PSPs), and Telecom Providers—in order to accurately identify and assess barriers to digitalisation, and strengthen existing infrastructure, and regulatory and policy frameworks.

Additionally, the application of tools and methodologies such as cost-of-payments analyses and customer journey mapping can provide valuable insights into the true cost and challenges associated with existing payment flows, while also identifying gaps and opportunities for policymakers.

Such findings are critical to defining implementation roadmaps, which will seek to leverage FinTech solutions and other incentives to boost the development of local financial systems and bring much-needed services to the underserved and vulnerable groups in society.

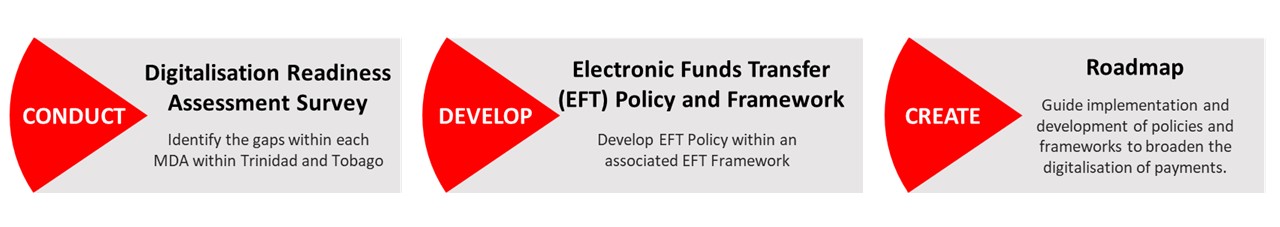

Key Initiatives

The TTIFC’s Approach to Accelerating the Digitalisation of Payments Across the Government

The Digitisation Readiness Assessment follows a Digital Readiness framework that aids government agencies in identifying gaps, opportunities, and strategies to support modification and/or development of relevant policies and frameworks for digital payment methods.

The Digitisation Readiness Assessment follows a Digital Readiness framework that aids government agencies in identifying gaps, opportunities, and strategies to support modification and/or development of relevant policies and frameworks for digital payment methods.- Electronic Funds Transfer (EFT) Framework and Policy are developed to streamline the enablement of EFT payment methods for use by MDAs. These practical set of actions are underpinned by best practices for the digitalisation of payments.

- The roadmap provides a detailed action plan to ensure the timely and effective implementation of digital payment methods across government agencies.