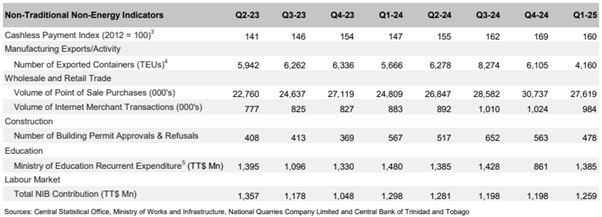

Trinidad and Tobago is undeniably transitioning to a more digital financial landscape. According to the Central Bank of Trinidad and Tobago’s (CBTT) Economic DataPack, June 2025, there is a positive trend with a 13.5% increase in the ‘Cashless Payment Index’, around 12% growth in Point of Sale (POS) volumes, and a significant 19% rise in internet transactions between Q2 2023 and Q4 2024. This isn’t just theory; it is evident in our daily lives

The Central Bank of Trinidad and Tobago Economic DataPack – June 2025

_____

Figure 1 | The CBTT, Economic Data Pack – June 2025 | DOMESTIC ECONOMIC INDICATORS: Non-Traditional Non-Energy Indicators

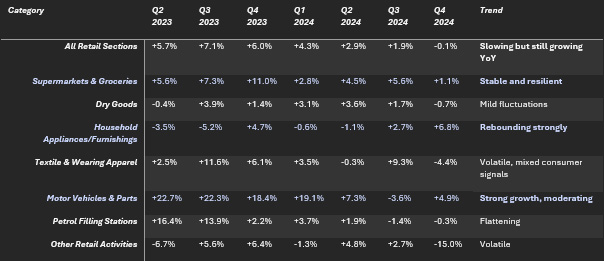

For many consumers, the digital payment journey starts with everyday essential purchases. However, while digital convenience is becoming increasingly prevalent in these areas, it is crucial to identify the factors that still hinder a completely seamless digital payment experience. To better understand the impact of these indicators on the increasing consumer willingness to adopt digital payment methods across different retail sectors, we have provided a Breakdown of Digital Payment-Related Consumer Categories in Figure 2.

____

Figure 2 | Breakdown of Digital Payment-Related Consumer Categories

Supermarkets and Groceries Have Become the Foundation of Digital Payment Habits

When it comes to essential spending, the Supermarkets and Groceries segment stands out as a steady adopter of digital payments. This sector has demonstrated stable and resilient growth, with consistent positive year-over-year changes, ranging from +5.6% in Q2 2023 to +1.1% in Q4 2024. This consistent growth aligns perfectly with the rising usage of debit cards. Think about it: a quick tap or swipe at the grocery checkout is often faster than fumbling for cash. The potential for wider QR and mobile wallet adoption in this space is also significant, promising even more frictionless transactions.

Beyond groceries and supermarkets, other sectors are showing promising signs of a digital embrace for high-value items, such as Motor Vehicles and Parts, which saw strong growth (e.g., +22.7% in Q2 2023 and averaging 11.9% growth QoQ), suggesting an increase in electronic payments. Even household appliances and furnishings are rebounding strongly, with a 2.1% growth in Q4 2024 from Q4 2023, indicating a greater use of cards for larger purchases.

Petrol Stations: A Pause in the Digital Drive?

Petrol Filling Stations initially demonstrated significant growth in digital payment transactions, boasting a +16.4% increase in Q2 2023. This makes sense – a quick tap at the pump is inherently convenient. However, by Q4 2024, this growth began to plateau (-0.3%), which could signal either digital saturation within this specific payment type or perhaps a shift towards consumer belt-tightening.

While these sectors highlight a growing willingness to shift toward digital payment methods, they also illuminate areas where cash remains stubbornly dominant.

The Persistent Trend: Why Cash Continues to Dominate for Daily Needs

Despite the convenience, cash remains the king for many everyday transactions. According to the National Financial Inclusion Survey Report (2023), a staggering 91% of the population still uses cash for phone bill top-ups, and 80% rely on cash for educational and utility bills. Why is there such a heavy reliance on physical currency for frequent, routine payments?

One of the most frequently cited reasons is the cost of digital transactions. Consumers maintain a reserved view about digital payment methods, stating that, “Every time you use your card it is at a charge, so I prefer to use cash. If I have to [go to] the grocery then I’m using cash, it’s not a problem”. This sentiment is understandable when considering that LINX transaction fees are TT$0.75, while other digital transfer fees, such as ACH, can range from TT$5 to TT$170, and RTGS fees are even higher, from TT$40 to approximately TT$170. These charges, even seemingly small ones, accumulate and act as a significant deterrent, especially for lower-value or frequent transactions.

Furthermore, a concerning 16% of consumers reported being surprised by terms and fees after opening an account, specifically citing “high maintenance or hidden fees”. This lack of transparency erodes trust and can prompt users to revert to cash. The call from some consumers for financial institutions to be “more upfront with fees and product details” and to have “less restrictions” is a clear signal that transparency and affordability are paramount.

Another barrier is the digital capability gap. A significant 56% of account holders lack the knowledge to own and use a mobile banking app. This suggests that even for those within the formal financial system, including a substantial portion of the employed population (572.3 thousand as of Dec-24), leveraging digital tools for everyday payments is still a challenge. Concerns about cybercrime and privacy also weigh heavily on consumers’ minds, with some senior citizens specifically mentioning the difficulty in understanding “these new financial arrangements” and a desire for guidance to engage with formal financial services and digital payments fully.

Cultivating the Daily Digital Habit

The potential for greater digital adoption in everyday essential spending is immense. Consumers inherently value the convenience that digital payments offer, describing them as “More Convenient,” allowing for “Quicker Transactions,” reducing the “Risk of Theft,” and providing “Ease of Use” compared to cash or cheques. The youth, in particular, express a preference for automatic bill payments, appreciating the time-saving benefits.

To truly cultivate a “daily digital habit” for all essential spending, and not just in specific sectors, a concerted effort is needed to:

- Minimise or eliminate transaction fees for everyday digital payments, especially for micro-transactions, to make digital payments financially competitive with cash.

- Enhance digital literacy and digital financial education programmes to empower all segments of the population, including seniors, to comfortably and confidently use mobile banking apps and other digital tools.

- Increase transparency regarding fees and product details to build greater trust between consumers and financial institutions.

- Promote automated payment solutions for recurring bills, highlighting the convenience and time-saving benefits to reduce reliance on cash for these routine transactions.

Turning sporadic digital adoption into a daily routine will enhance efficiency and convenience for all citizens in Trinidad and Tobago. This guarantees that everyone, especially the unbanked and underserved, can safely and confidently access essential financial products and services and fully realise the transformative potential of a genuinely inclusive digital economy.

To learn more about Financial Inclusion in Trinidad and Tobago and to improve your digital financial literacy, visit ttifc.co.tt or contact us.

Survey participant feedback: The National Financial Inclusion Survey Report (2023)